Clark Wealth Partners Can Be Fun For Everyone

Table of ContentsGet This Report about Clark Wealth PartnersSome Known Details About Clark Wealth Partners Clark Wealth Partners Can Be Fun For EveryoneClark Wealth Partners for DummiesNot known Facts About Clark Wealth PartnersThe 9-Second Trick For Clark Wealth PartnersThe Greatest Guide To Clark Wealth PartnersThe 7-Minute Rule for Clark Wealth Partners

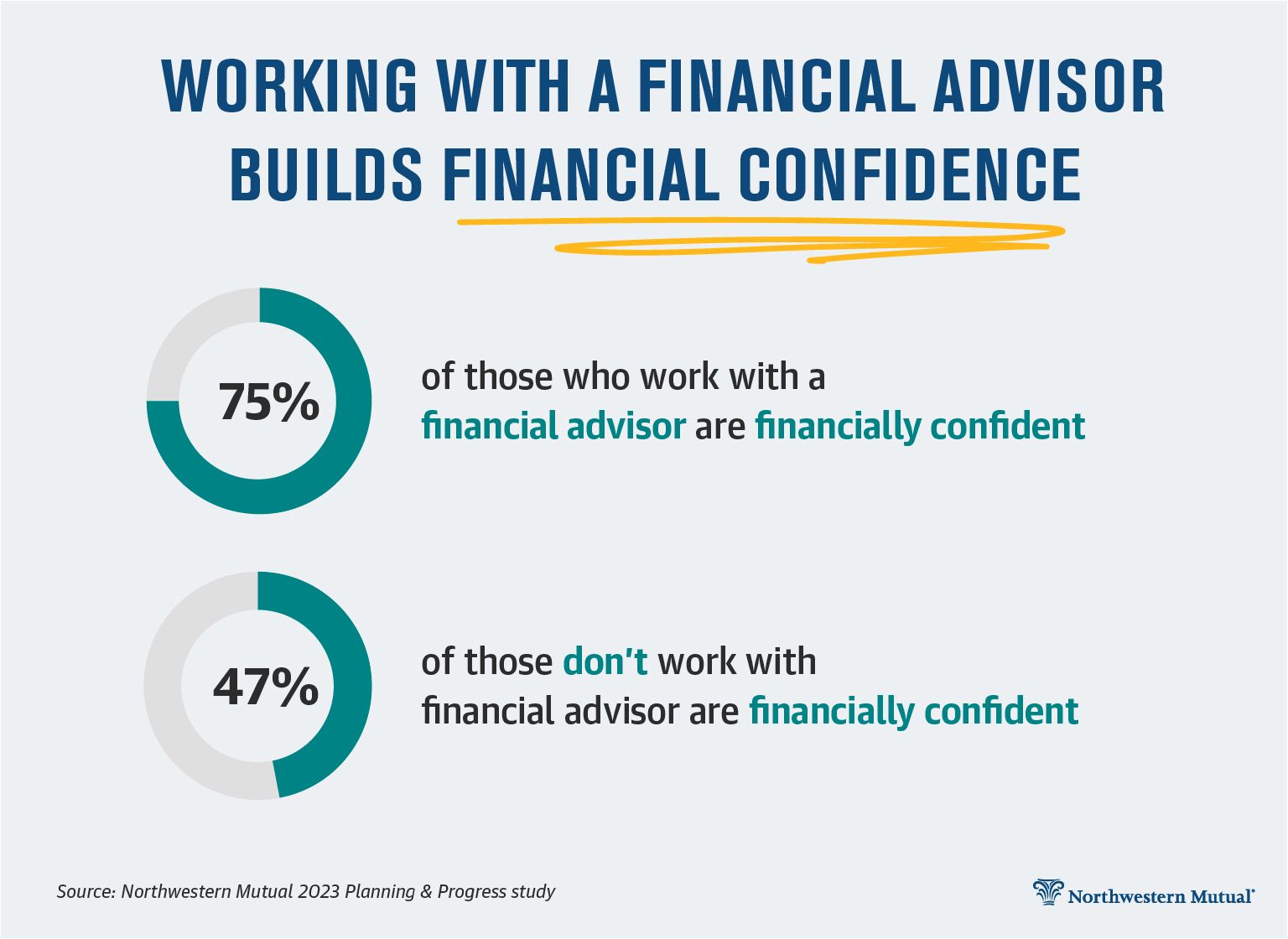

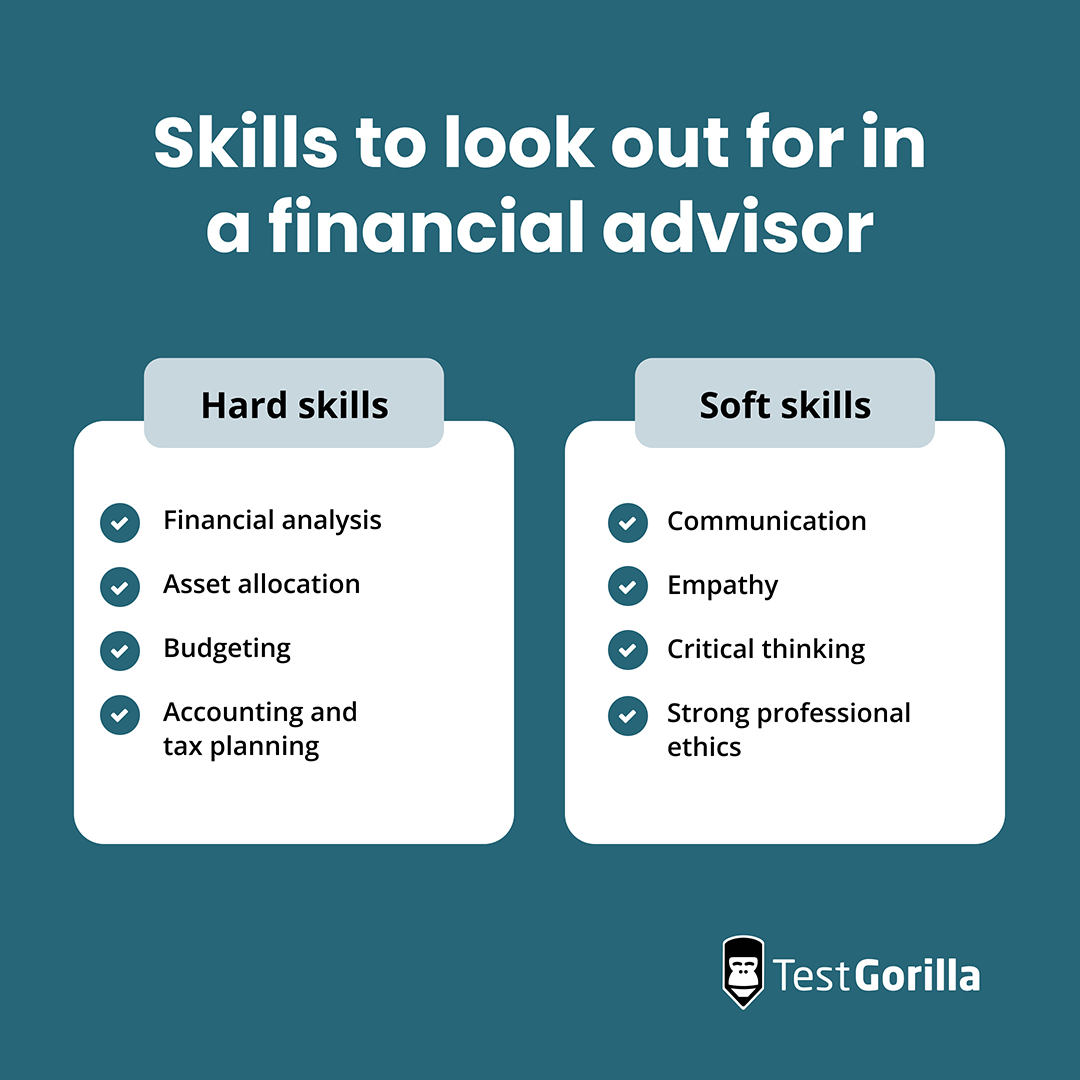

Usual reasons to think about a monetary advisor are: If your monetary circumstance has actually come to be more complicated, or you do not have self-confidence in your money-managing skills. Saving or browsing significant life events like marital relationship, separation, kids, inheritance, or job modification that might substantially influence your financial circumstance. Navigating the shift from saving for retired life to protecting wealth throughout retirement and exactly how to produce a strong retirement income plan.New innovation has actually led to more thorough automated financial tools, like robo-advisors. It's up to you to examine and establish the ideal fit - https://www.pinterest.com/pin/900368150514394496. Ultimately, a good economic consultant needs to be as conscious of your financial investments as they are with their very own, preventing extreme costs, conserving cash on tax obligations, and being as clear as possible concerning your gains and losses

Clark Wealth Partners Fundamentals Explained

Earning a commission on product suggestions does not necessarily indicate your fee-based consultant functions versus your benefits. They might be a lot more likely to advise items and services on which they earn a payment, which may or might not be in your finest interest. A fiduciary is lawfully bound to put their customer's passions initially.

This standard enables them to make referrals for financial investments and services as long as they match their customer's goals, threat tolerance, and economic circumstance. On the other hand, fiduciary advisors are lawfully obligated to act in their customer's ideal rate of interest rather than their very own.

The Facts About Clark Wealth Partners Revealed

ExperienceTessa reported on all points spending deep-diving right into complicated financial topics, clarifying lesser-known investment methods, and discovering methods visitors can function the system to their benefit. As a personal financing specialist in her 20s, Tessa is really aware of the impacts time and unpredictability carry your investment choices.

It was a targeted advertisement, and it functioned. Read extra Read less.

The Best Strategy To Use For Clark Wealth Partners

There's no single course to turning into one, with some people beginning in banking or insurance coverage, while others begin in bookkeeping. 1Most monetary planners begin with a bachelor's degree in finance, economics, accountancy, service, or an associated topic. A four-year level gives a solid structure for jobs in financial investments, budgeting, and customer service.

The Of Clark Wealth Partners

Typical examples consist of the FINRA Series 7 and Collection 65 examinations for safeties, or a state-issued insurance policy permit for selling life or medical insurance. While qualifications may not be legitimately needed for all preparing duties, employers and customers usually see them as a benchmark of professionalism. We take a look at optional qualifications in the next area.

Most economic planners have 1-3 years of experience and knowledge with financial products, compliance criteria, and direct client communication. A solid instructional history is crucial, however experience demonstrates the capacity to apply theory in real-world settings. Some programs incorporate both, enabling you to finish coursework while making monitored hours via teaching fellowships and practicums.

All about Clark Wealth Partners

Very early years can bring lengthy hours, stress to build a customer base, and the need to continuously prove your competence. Financial organizers take pleasure in the possibility to function carefully with customers, guide important life decisions, and frequently achieve versatility in schedules or self-employment.

Riches managers can raise their earnings with payments, possession charges, and performance bonuses. Economic managers supervise a group of economic coordinators and consultants, establishing departmental approach, handling compliance, budgeting, and directing interior procedures. They spent less time on the client-facing side of the sector. Nearly all economic managers hold a bachelor's level, and many have an MBA or similar academic degree.

The smart Trick of Clark Wealth Partners That Nobody is Discussing

Optional qualifications, such as the CFP, usually require extra coursework and screening, which can prolong the timeline by a number of years. According to the Bureau of Labor Stats, personal financial advisors earn an average yearly annual wage of $102,140, with leading earners making over $239,000.

In various other provinces, there are guidelines that require them to meet certain demands go to website to make use of the monetary expert or monetary organizer titles. For financial planners, there are 3 typical classifications: Licensed, Personal and Registered Financial Coordinator.

Not known Factual Statements About Clark Wealth Partners

Where to locate an economic advisor will depend on the type of recommendations you require. These organizations have staff that may assist you understand and get certain kinds of investments.